PrivoCorp offers a suite of services in Compliance / Legal:

-

GMI

Compare borrowers information with borrowers demographic data and update the HMDA codes -

OFAC

Review and research the borrowers information received against OFAC SND list -

HMDA scrubbing

HMDA requires many financial institutions to maintain, report, and publicly disclose information about mortgages Data needs to be scrubbed with any identified reporting errors and resolved before it submits to LARs

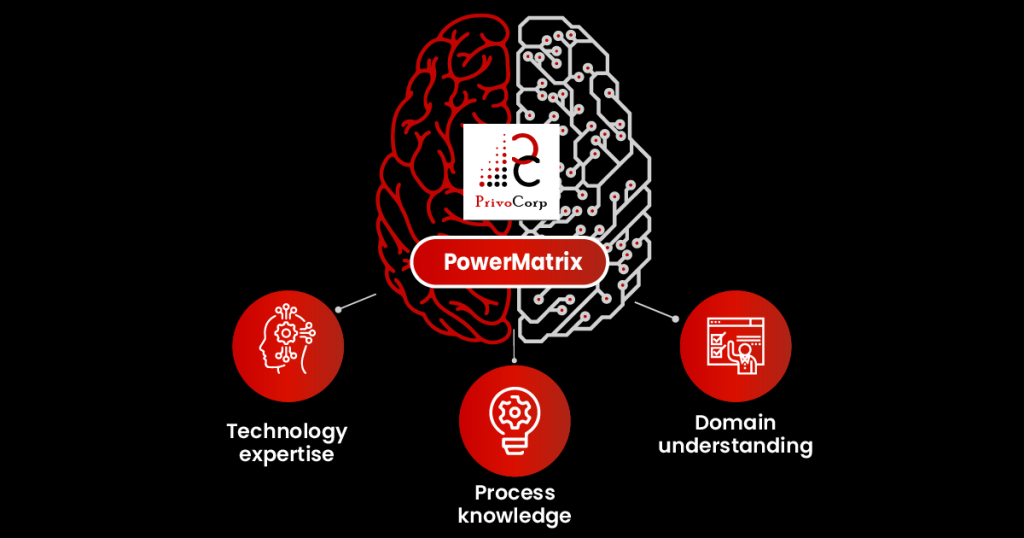

PrivoCorp's PowerMatrix

The PowerMatrix solution suite is the driving force behind PrivoCorp’s success across its origination and servicing solutions. It epitomizes the fusion of unparalleled Mortgage domain understanding, cutting-edge Technology expertise, and comprehensive Process knowledge.

PowerMatrix stands as a testament to the company’s unwavering commitment to excellence in the mortgage industry.

PowerMatrix empowers PrivoCorp to consistently deliver top-tier service and solutions to its mortgage clients, that are tailored to their specific needs.

Find out how PrivoCorp can help in improving borrower experience and retaining them

Benefits of Partnering with PrivoCorp for Servicing

- Over a decade of experience in End-to-End Component Servicing

- Headquarters in Austin, TX with two production facilities located in India

- Experience working with all the leading Compliance and Servicing platforms

- Flexible engagement model to help you reduce fixed costs

- SSAE 18 compliant (SOC 2 audit in the process)

Have Questions that you would like answered?

Testimonials

“PrivoCorp is a remarkable firm, and we are consistently pleased with their mortgage servicing assistance and services, as well as their amazing team. They are adaptable to our ever-changing needs and a pleasure to deal with”

Martin

SVP Servicing Operations, Leading Sub-Servicing Firm

“Working with the PrivoCorp team has been a pleasure. They have been very responsive and knowledgeable”

Bob

Bob

Operations Head for a Mortgage Company