Credit Unions can often provide better or equivalent rates for all their mortgage products. We see many credit unions relying on service providers to help manage their day to day operations. That helps credit unions maintain profitability, reduce fixed costs, lower operational risks, increase quality without having to invest in technology and people.

Credit Unions offer a variety of mortgage products to their members.

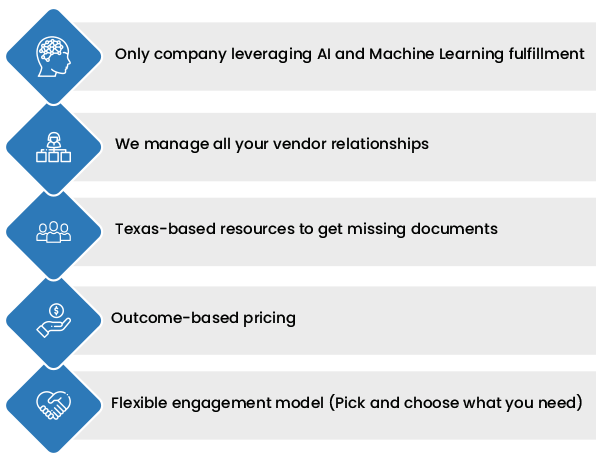

At PrivoCorp, we support Credit Unions with end-to-end mortgage fulfilment.

Our 10+ years of experience working with customers, self-motivated teams, automated workflows, and intelligence powered by AI and Machine Learning technologies and digital compliance ensures operational efficiency and customer satisfaction with our clients.

Partnering with PrivoCorp for your end-to-end mortgage fulfilment can help you save loan cycle time, reduce fixed costs while giving you a competitive advantage in the market.

- Loan Document Indexing: Collect & Review Borrower Documents

- Order VOE, VOD, VOM and VOR

- Order Appraisal, Title, Hazard and Flood Certificates

- Order VA and FHA Case Numbers for Government Loans

- Order Tax Certificates

- Generate LE and TIL Disclosures

- Collect Signed Disclosures and Verify

- Verification of HOI (Homeowners Insurance)

- Title Search & Report Preparation

- Credit Review

- Contract Review

- Review Flood Certificate

- Review Appraisal Report

- Fraud Review

- Title Review

- Document Preparation

- Scheduling of Closing

- HUD Reviews

- Closing File Review

- Recording Support

- Post-closing Review and Exception Curing

- Suspense / Exception Reporting

- Trailing Documents

- Investor Guideline Review

- Final Document Indexing

Benefits of partnering with PrivoCorp

- Headquartered in Austin, TX with locations in Dallas, TX, Singapore and India

- Experience working with all the leading LOS, Compliance and Servicing platforms

- Flexible engagement model to help you reduce fixed costs

- SSAE 18 compliant (2021 SOC 2 audit in the process)