In the ever-evolving landscape of real estate and finance, title services play...

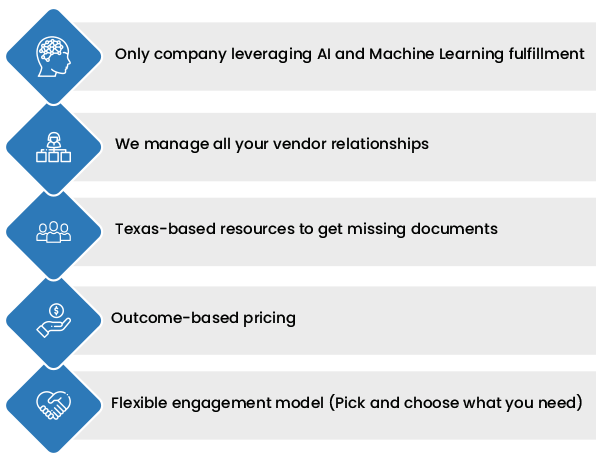

Read MoreWe are among the very few full-service ‘mortgage processing’ companies. We provide processing support that cuts across origination as well as post-closing. We implement strategic tools and process transformation to address the mortgage industry’s operational and customer experience challenges. Our self-motivated teams, automated workflows, intelligence powered by AI and Machine Learning technologies, and digital compliance ensures operational efficiency and customer satisfaction for our clients. Although many lenders believe in a fragmented approach while assigning processing work, we believe this full-service mortgage processing is still widely needed in the mortgage industry today.