Valuable underwriter resources are often wasted on low-quality loan files, diverting focus from high-quality ones. Quality Loan Setup addresses this by prioritizing high-quality files, accelerating loan processing, enhancing underwriter productivity, and streamlining operations for lenders. Additionally, it flags loan officer performance based on the quality of submitted files, enabling targeted improvement programs for sustained efficiency.

PrivoCorp's Quality Loan Setup accelerates loan processing and enhances underwriter productivity for seamless lending operations.

Lender's Problems

Low-Quality

Loan Files

Increased rework, higher operational costs.

Underwriter Burnout

High stress levels, reduced productivity.

Wasted

Resources

Valuable underwriter time spent on low-quality files.

Missed Opportunities

Lost revenue due to delayed closings.

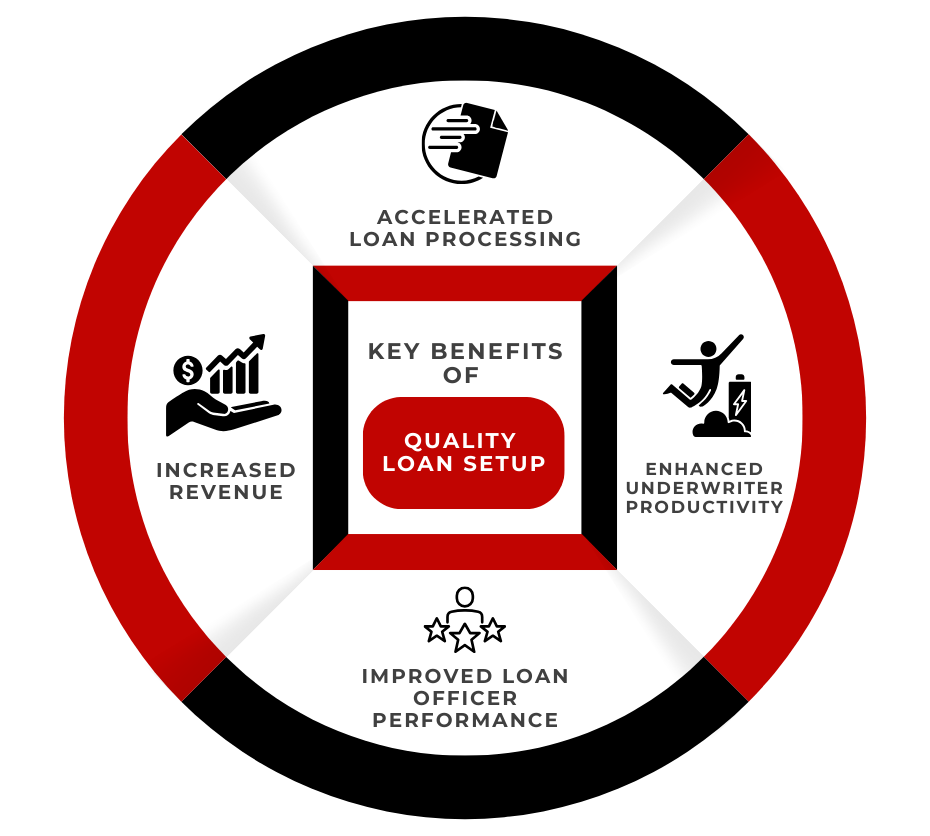

Key Benefits of Quality Loan Setup

-

Accelerated Loan Processing

Streamline the underwriting process with QLS, ensure high quality files with the underwriter, reduce turnaround time. -

Enhanced Underwriter Productivity

Prioritize high-quality files with QLS. This ensures reduced iterations and rejections leading to improved productivity. -

Increased Revenue

Prioritize high-quality, easy-to-close loans, resulting in faster closings, retaining borrowers and thereby increased revenue. -

Improved Loan Officer Performance

Flag loan officer performance based (GOR) on the quality of loan files submitted, so that improvement programs can be initiated.

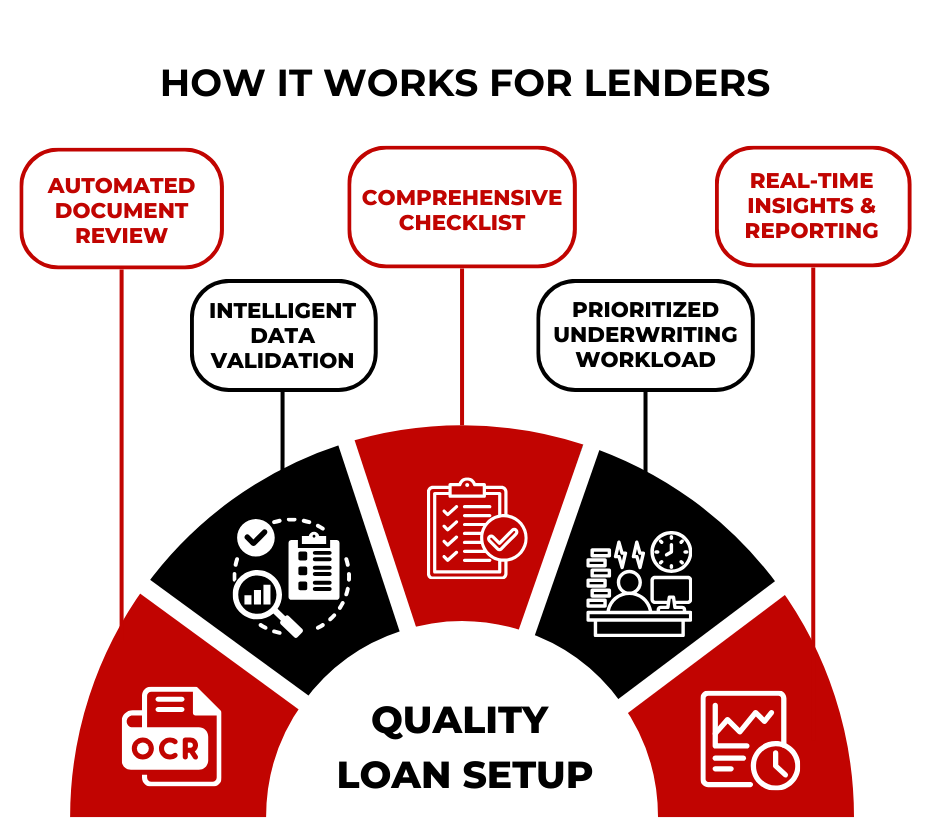

Key Features of QLS

- Automated Document Review: Quickly assess loan documents for completeness and accuracy using advanced OCR technology, saving time and reducing errors.

- Intelligent Data Validation: Identify and flag potential issues early in the process, preventing delays and ensuring compliance.

- Comprehensive Checklist: Ensure all necessary documents and information are collected and verified, minimizing delays and errors. These checklists are customizable as per lender requirements.

- Prioritized Underwriting Workload: Focus on high-quality, easy-to-close loans first, maximizing efficiency and revenue.

- Real-time Insights and Reporting: Monitor key performance indicators, including loan officer performance based on file quality, enabling data-driven decision-making.

Stack, Pack & Rack Approach: An Integral Part of QLS

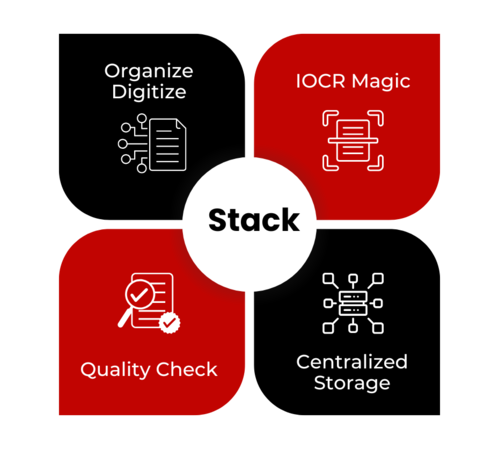

Stack: Initial File Intake & Processing

-

Organize and Digitize:

Loan files are collected and categorized. -

OCR Magic:

Documents are scanned and converted to digital format. -

Quality Check:

Human verification ensures accuracy and completeness. -

Centralized Storage:

Files are made available in a secure, accessible repository.

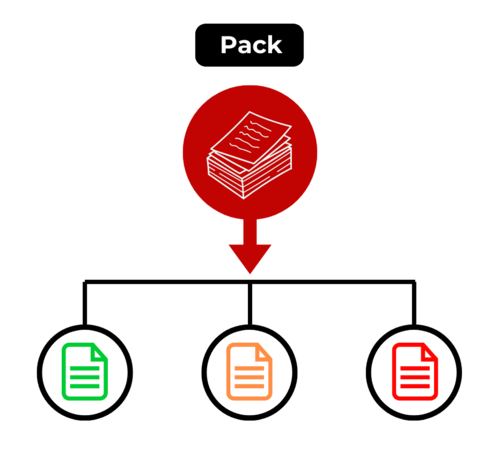

Pack: Flagging/Separating Loan Files

-

Green:

High-quality, ready for immediate processing -

Orange:

Good quality, requires minor attention -

Red:

Low-quality, needs significant rework

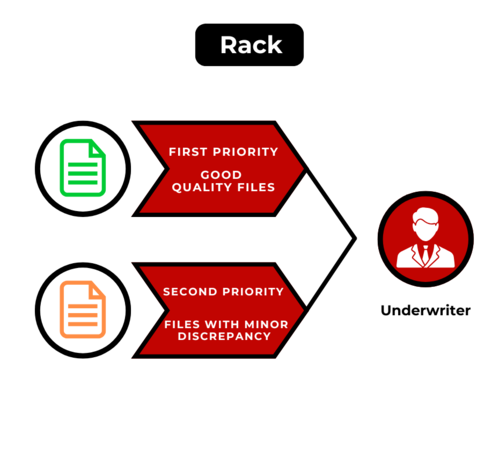

Rack: Prioritizing and Routing Loan Files

-

Green Lane:

High-quality files are fast-tracked to underwriters -

Orange Alert:

Files requiring minor fixes are routed for quick attention

Find out how PrivoCorp can help in improving borrower experience and retaining them

Testimonials

“PrivoCorp is a remarkable firm, and we are consistently pleased with their mortgage servicing assistance and services, as well as their amazing team. They are adaptable to our ever-changing needs and a pleasure to deal with”

Martin

SVP Servicing Operations, Leading Sub-Servicing Firm

“Working with the PrivoCorp team has been a pleasure. They have been very responsive and knowledgeable”

Bob

Bob

Operations Head for a Mortgage Company