The mortgage processing industry is a complex ecosystem that has a highly regulated environment and the need for a delicate balance between modernization, cost, and risk. Processing larger mortgage volumes is an element that requires more efficient services on part of lenders and processors.

Processing Higher Mortgage Volumes

At a time when more millennials are pursuing homeownership than ever before, the volumes of mortgages are bound to go up. Over the past few years, it has been observed that as millennials age and grow in their careers, they are acquiring more purchasing power, are shopping for mortgages online, and entering the market well prepared.

In this background and considering that the mortgage industry is process-oriented, it requires a strong pull-through ratio, especially if the volumes are high, in order to eschew spending higher costs on processing. A better pull through is possible with factors like strong customer experience, engagement, faster processing, and quicker onboarding.

To meet these challenges, lenders need to take a holistic approach to the entire loan origination cycle by streamlining processes through automation where possible. It is best to embrace digital technologies such as Artificial Intelligence (AI), Robotic Process Automation (RPA), Chatbots, etc to gain a competitive advantage. An effective way to deploy technology and offer a seamless digital experience to customers is to partner up with mortgage processing companies who have a strong digital footprint.

How Digitization Can Help Power the Process

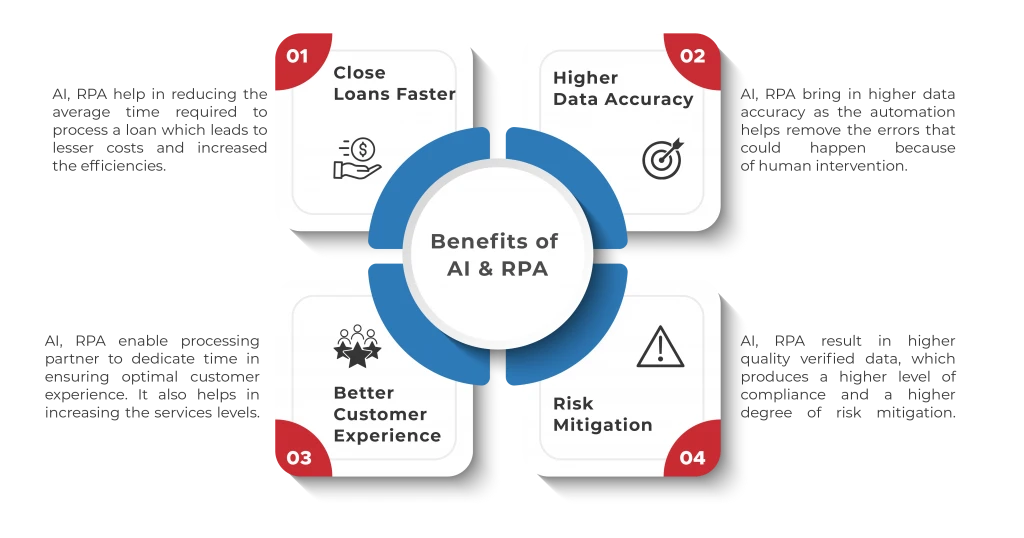

AI-powered RPA can help lenders solve specific processing problems and increase productivity by as much as 20-30%. These technologies are proving to be driving forces in helping improve on loan processing time, quality, compliance and cost challenges. While it is still slightly new in the industry, RPA has already started to dramatically streamline the mortgage lending process. Given the complex, highly rule-based and structured nature of processes in the mortgage industry that involves various systems, RPA is providing incredible advantages. These software robots are helping plug the gaps created by disjointed systems without massive integration requirements or a huge IT budget.

RPA implementation is going a long way in helping processing companies and lenders to focus on strategic, value-added activities to provide better customer experience, while the bots are involved in significantly improving the actual loan processing.

AI-powered RPA can be used for a mortgage right from the process of loan origination. Through the application of rule-based algorithms, RPA solutions can ensure data is more accurate to increase turnover time and for implementing better reporting. These can be achieved by automating repetitive and time-consuming manual tasks. This includes aspects like verification of pre-funding data, tasks related to ordering services such as credit, title, flood, quality audits of documentation submitted, etc.

AI & RPA presents several opportunities for adding agility to multiple processes. Since RPA is rule-based, it can accelerate loan eligibility verification based on predefined criteria that every application is evaluated for.

Another important area where AI-powered RPA can be applied in the mortgage industry is Risk and Compliance oversight. Implementation of RPA has not only resulted in the reduction of risks from human errors, but it has also streamlined compliance reporting and risk mitigation. Automation immediately reduces manual errors, such as keying mistakes, misapplied rules, etc. RPA has also helped scale-up risk monitoring and reporting.

Conclusion:

Robotic process automation solutions can help improve the effectiveness of mortgage services faster and at a much lower cost. Mortgage lenders need to harness AI-powered RPA to accelerate responsiveness, shorten the mortgage application process, and protect both the lender and the borrower from fraud. They can partner with expert and experienced mortgage processing partners. PrivoCorp is one such mortgage loan processing company that has a strong digital footprint. Connect with PrivoCorp now!